The word "wallet" gets used a lot, but is rarely defined. Whether you're fresh to web3 or a seasoned veteran, you've likely felt this confusion. Even worse: maybe you don't know you're confused? Let me explain.

What Is a Wallet?

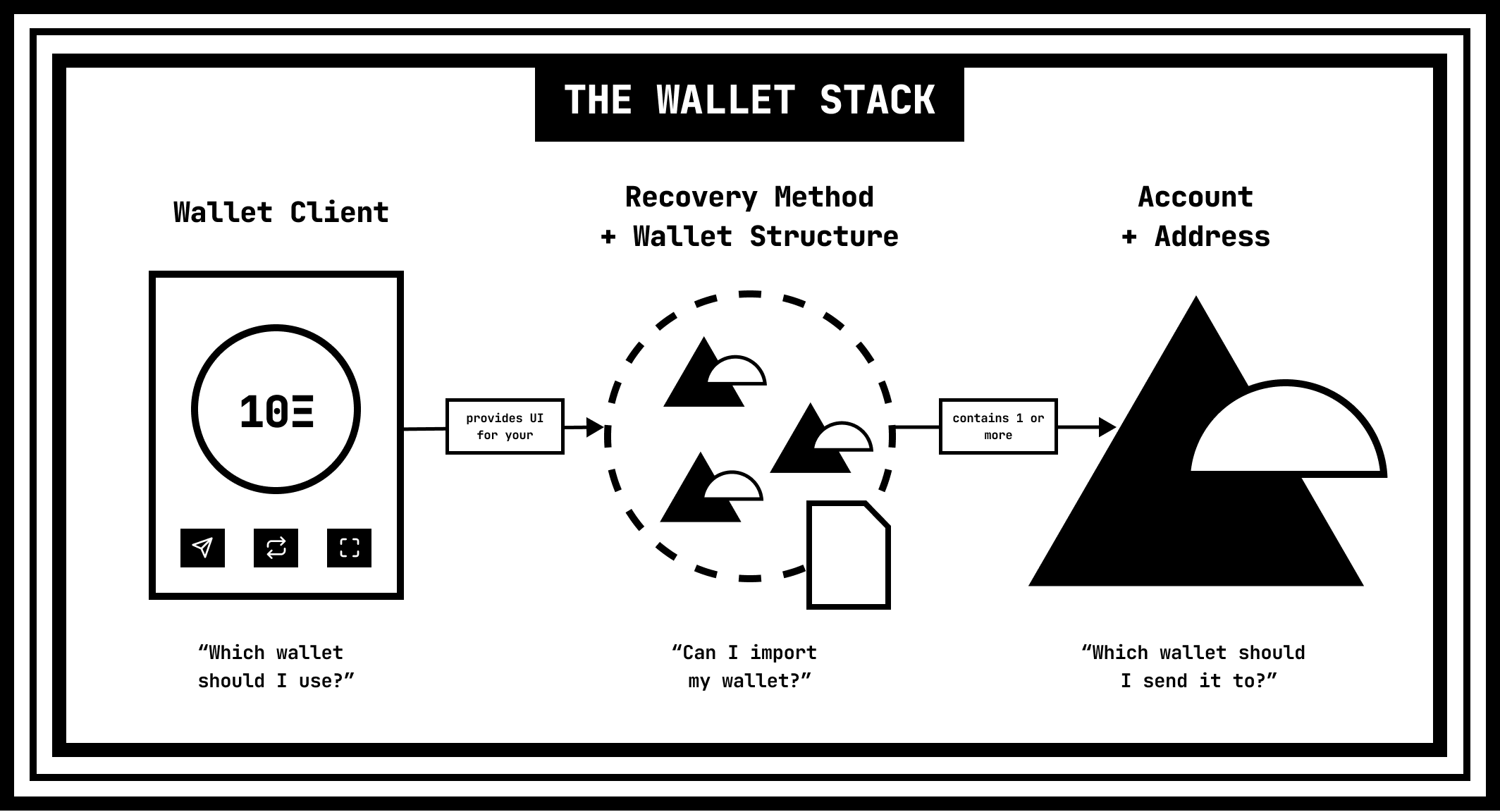

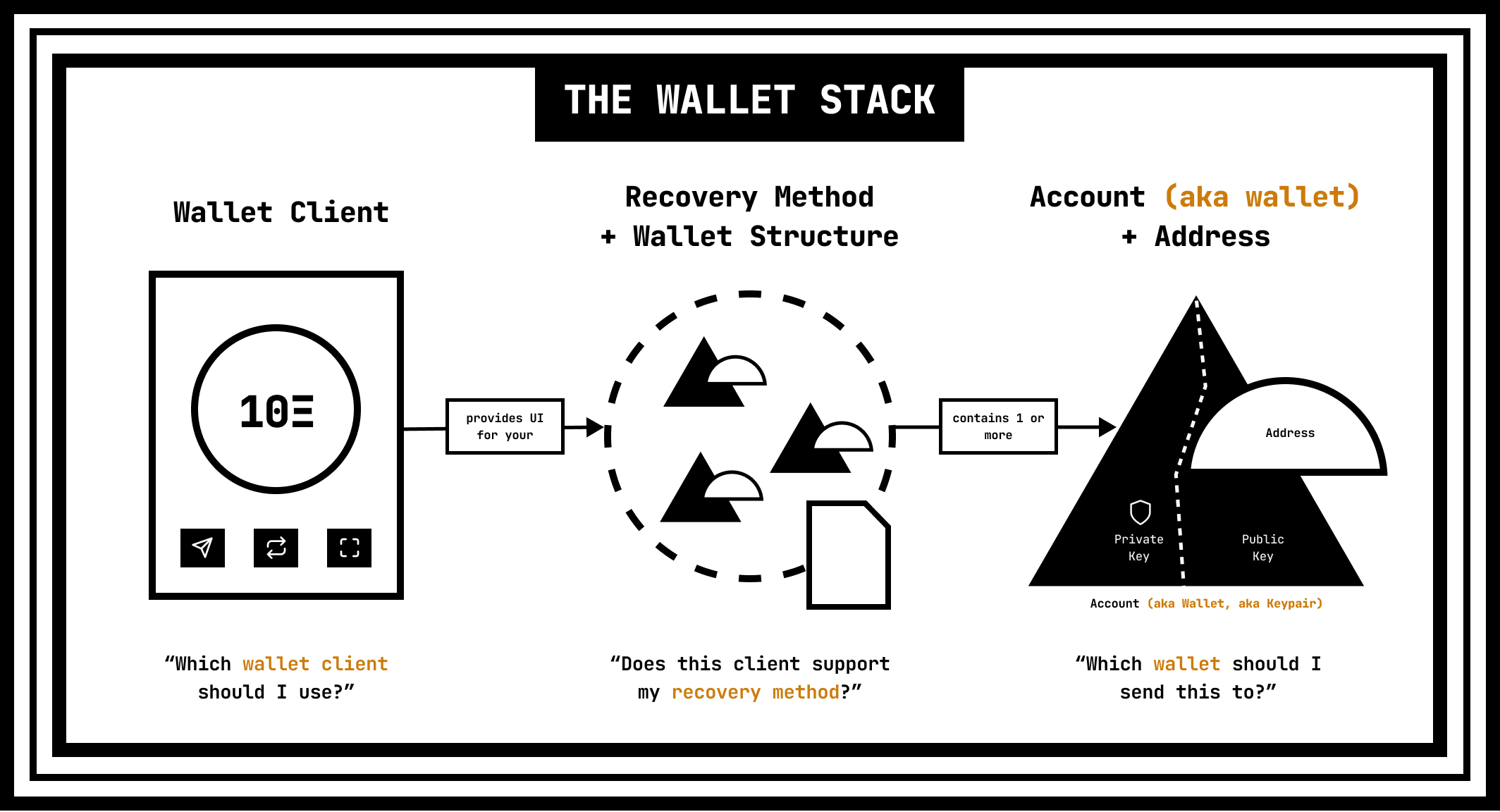

- "Which wallet should I use?"

- "What wallet should I send this to?"

- "Can I import my wallet?"

In each of these questions, "wallet" refers to a completely different part of the Wallet Stack: a Wallet Client, an Account & Account Address, and a Recovery Method—which itself infers the existence of a Wallet Structure.

Colloquially, calling every part of the stack a "wallet" isn't an issue. For many people right now, they all indeed feel like the same thing. Where the problem becomes real is in the UI copy itself.

Across and within various Wallet Clients, the word wallet leaks inconsistently into the user experience. It's no wonder people get confused. For new users this can be misleading. For experienced users it may never be clear what's actually going on underneath.

Let me pick on Coinbase Wallet for a moment to ground this in an example. Not only are they the most successful brand in blockchain, they are also one of the worst abusers of the word wallet.

To enter Coinbase Wallet's world, one must:

- Install Coinbase Wallet (a

Wallet Client), which will prompt you to - Create a new Wallet (aka set up a new

Recovery Methodthat will generate a password protectedWallet Structure), at which point - The app will provision you with 10 Wallets (which are actually 10

Accountsidentified by their uniqueAccount Addresses).

Because many people only go through this flow once, and never bother going into settings, their confusion may be fleeting. But can you imagine what internal Coinbase Wallet sprint planning looks like? "Alex, can you fix the bug with wallets being derived non-deterministically from the wallet a user imports into the latest version of our wallet?"

Poor Alex. Poor us.

Those of us designing and building need to be more precise. So: let's get precise.

A couple of notes: This post uses Ethereum examples, but the ideas hold true for smart contract enabled chains in general, and will be identical in practice for all EVM compatible chains. You’ll also notice I’m explicitly not using the word dapp. If a dapp is software whose backend is strictly hosted on a blockchain, that is a subset of all apps. I believe all apps will have wallet interactions in the near future.

Wallet Clients

When someone asks "Which wallet should I use?" what they're really asking is "Which wallet client should I use?"—examples being Metamask, Rainbow, Coinbase Wallet, a Ledger Nano, or a Gnosis Safe. The Wallet Client is the interface they'll use to connect to an app, sign messages and transactions, and manage their on-chain assets.

Varieties Of Wallet Client

A wide variety of Wallet Clients exist, and the list grows daily. To thoughtfully recommend one, it's important to know a bit more about a person's intentions. What's their threat model? Which chain(s) are they going to be using? What do they want to do in web3?

Even with clear answers to those questions, making the right recommendation can be complicated. There are just so many options out there. It’s helpful to think about the ways you can categorize Wallet Clients:

- Software vs Hardware: Most folks will start out by using a software wallet on their laptop, tablet or phone—either in the form of a native app, web app, or a browser extension. Eventually, they're going to want more security and are likely to move to something like a Ledger Nano—a dedicated piece of hardware with embedded firmware. Software and hardware clients mostly map to the concept of hot wallets and cold wallets respectively. TLDR: putting valuable assets into cold storage on a hardware wallet client is a good move.

- Finance vs Identity-focused: Historically, folks have turned to their

Wallet Clientto manage the financial activity they’re engaged in on-chain: monitoring their portfolio value, or swapping and staking assets. But, over the past year we've seenWallet Clientssuch as Autonomy and Rainbow begin to support viewing and interacting with an NFT collection, and even constructing public profiles. These features address the emerging desire to garden on-chain identities—or rather, inventories. - Single vs Multi-chain: Most

Wallet Clientsfocus on support for a single blockchain ecosystem: Metamask on Ethereum, Phantom on Solana, Kepler on Cosmos, or Kukai on Tezos. But there are options that support multiple chains from a single interface. Trust Wallet may have the broadest blockchain support out of the box, while Metamask has begun supporting additional blockchain networks via its 3rd party Snaps add-ons. Single chainWallet Clientstend to be more mature and have better UX, but multi-chain clients are the final destination. - EOA vs Contract-based: Signing transactions and messages (for better and for worse) is the backbone of web3 experiences. Most

Wallet Clientsrely on Externally Owned Accounts (EOAs) under the hood and require a single signature to "okay" a transaction—we'll explain this in more depth shortly. When you want to up your security, diversify your recovery paths, bundle transactions, set spending limits, or support other sophisticated organizational workflows, there are also contract-based clients. Gnosis Safe and Argent are examples of contract-based clients that enable features such as multiple signatures (multi-sigs) to process a transaction. Beware: not all apps support multi-sigs directly.

Challenges Wallet Clients Face

- Overloaded Scope: At this moment in time,

Wallet Clientspull triple duty in the web3 space, handling: private key management, application UI, and transaction/asset management. Billy Rennekamp explains how this could be restructured with his proposed Account Coordinator pattern. - Not Being Metamask: If you're using anything other than Metamask, chances are high you're connecting your

Wallet Clientto an app using a wallet transport layer like Wallet Connect. Or you’re hoping yourWallet Clienthas decided to emulate Metamask. - Poor Mobile Support: On mobile, most apps expect you to copy the URL to your clipboard, open your

Wallet Client, launch its in-app web browser, and then paste the URL. Once again, implementingWallet Connectin your app helps alleviate this and allows your users to use their mobile browser of choice. As a sidenote, most web3-enabled apps are neither responsive nor mobile-friendly; it is imperative that developers and designers adopt a mobile first approach to user experience. - Inconsistent Terminology: Accounts? Wallets? Import? Add? Connect? Link? Different combinations of these words appear all over the place referring to different things. Hopefully this post will help to chip away at some of that confusion, but there is still a lot of ground to cover. It is critical the teams behind

Wallet Clientscontinue to engage in user research to identify the right mental models and terminology to support them—with a mind towards localization as well! - No Settings Portability: If you've ever tried migrating to a different instance of Metamask, or from Metamask to Rainbow Wallet—not picking on either of them specifically—you've learned with some frustration that you have to setup everything from scratch again: account names, block and allow lists, token lists, network settings, etc. That process is both tedious and error prone to do even once, let alone maintain on an ongoing basis.

- Centralization Under the Hood: Many of the user experience improvements wallets have achieved in terms of displaying assets and transaction history have been gained through leveraging highly centralized 3rd party APIs. Moxie Marlinspike published an excellent tear down of where this centralization has introduced fragility into the ecosystem. There are better ways.

Accounts & Account Addresses

When someone asks "Which wallet should I send this to?" what they're really asking is "What's the account address I should send this to?"—the long base-58 string that identifies your account on the chain.

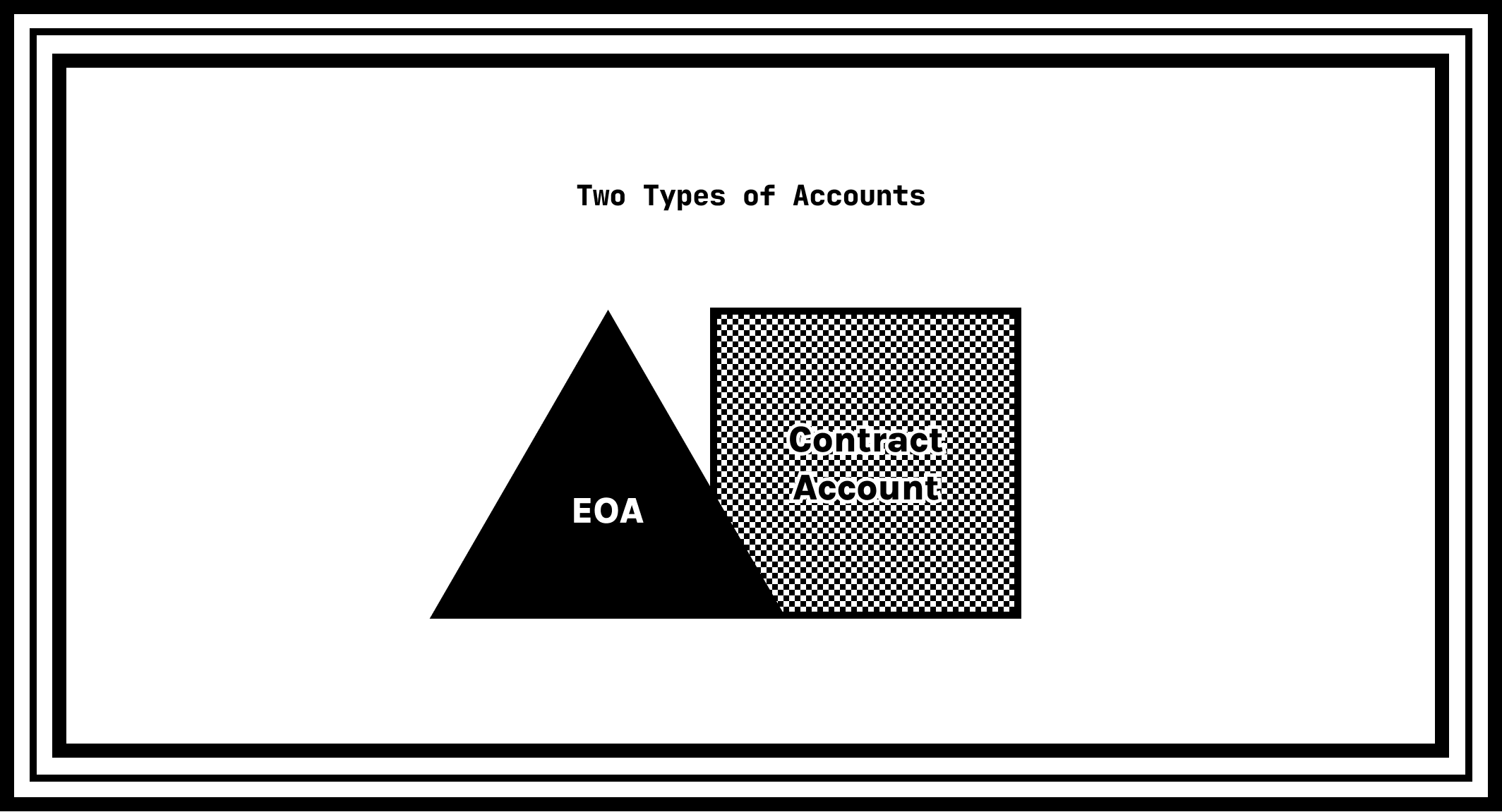

So, what exactly is the account that address identifies? Well, there are two distinct types.

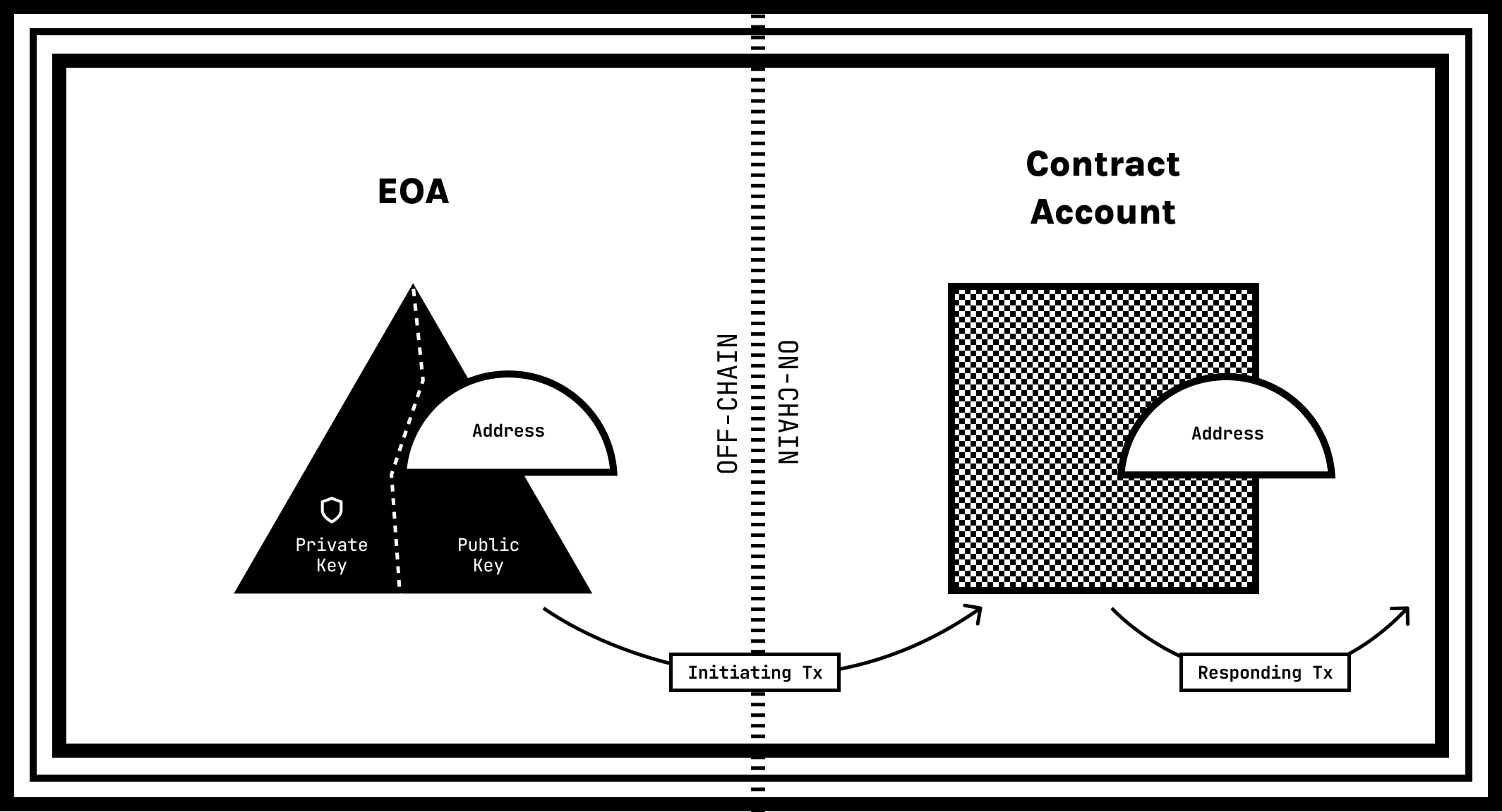

Externally Owned Accounts (EOAs):

- live off-chain—ie. they are "external" to the blockchain

- are controlled by a private key, from which a public key and address are derived

- are responsible for initiating all transactions

Contract Accounts:

- live on-chain as code

- are controlled by the functions defined in that on-chain code

- can only act in response to transactions issued by EOAs

Though Contract Accounts are becoming more common, most people still have EOAs. This is because, even if you use a Contract Account, an EOA must still be present somewhere in the chain to trigger the action you want to take—though there are plans in motion to address this with Account Abstraction.

With both types of accounts, the Account Address is the way that you refer to it in a transaction.

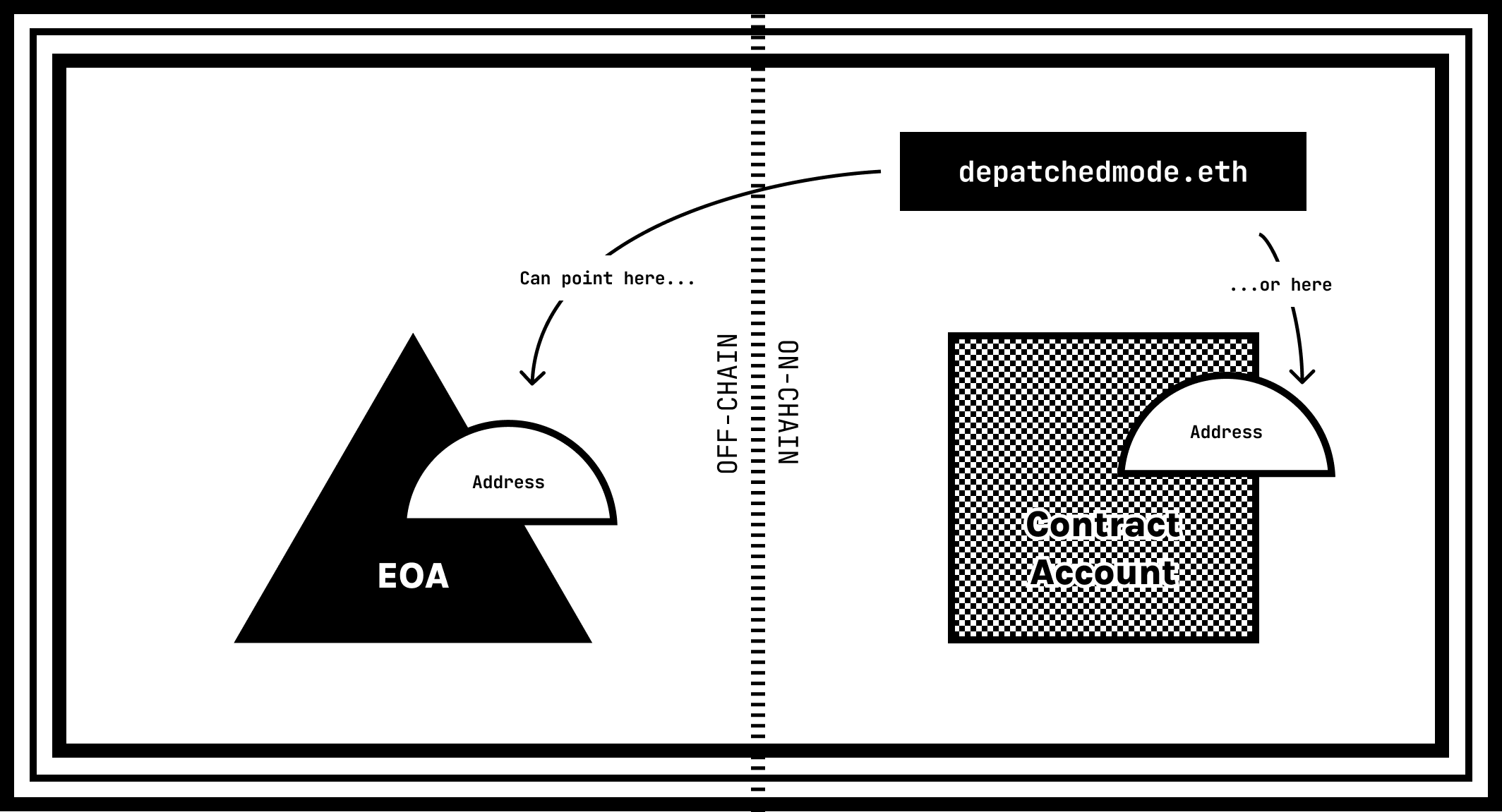

Human-Readable Aliases

Most folks can’t just remember and rattle off the 20 byte long base-58 string that is their Account Address. So, protocols such as ENS allow a human-readable alias to be mapped to any address. The result is that I can invite you to send tips to depatchedmode.eth (🤑) instead of forcing you to test the limits of human memory (and typing skills). Many apps and Wallet Clients support these aliases in both directions: raw addresses will show up as ENS domains when they exist, and pasting ENS domains in various places will resolve to their underlying addresses.

It is worth underscoring that you can change the address your ENS domain points to, in case you migrate to a new primary account in the future. Because of this, an ENS domain can be a more stable way to identify yourself to other people in much the same way that your phone number remains stable as you move from one home to the next.

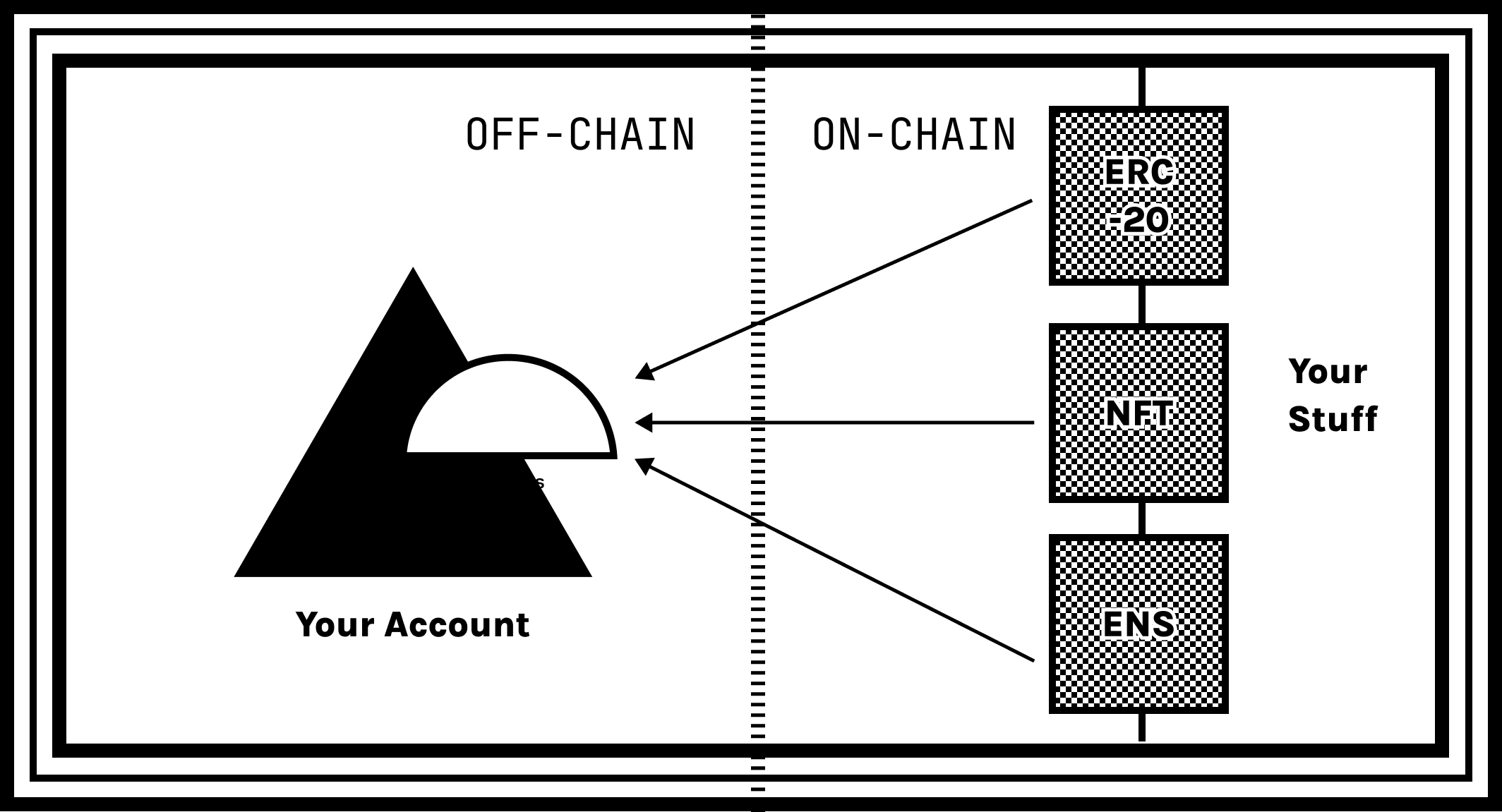

What's In Your Account?

Nothing. Surprised? This is one of the reasons that many people say a "wallet" is a broken metaphor. When you think of a wallet, you imagine a thing that:

- Contains Stuff: It’s full of coins, bills and cards that you fold up and slide into your front pocket.

- Is Default Private: Nobody can see any of that stuff unless you decide to show them.

The blockchain account you’re managing in your wallet shares neither of those characteristics. A blockchain account:

- Contains Nothing: When I say that nothing is in your account, I mean it. No matter what asset you are referring to, whether it be ETH, an ERC-20, or an NFT, the balance that is attributed to your account is stored elsewhere and points to your account. In the case of an EOA this shouldn't be surprising, because the assets are on chain and—as we just illustrated—your account is not. The same is true for contract accounts.

- Is Default Public: Anyone can look up your ENS domain or public address to see the entire list of current and past assets associated with that account, as well as all its transactions.

Challenges That Accounts Face

You need each of the following for Safe NFTing:

— 6529 (@punk6529) February 20, 2022

✅A multi-sig archival wallet for things you don't plan to trade. Don't connect this to any service at all.

✅Transaction wallet(s) for selling/buying main marketplaces only

✅Aping addresses for connecting to random new stuff

- Account Composition: Beyond the wallet being a broken metaphor, Dan Finlay has gone so far as to say recently that even "account" is a skeuomorphic dead end. And many folks are weighing in on how you might want to compose your set of accounts in order to best protect yourself against loss and theft.

- Consent Layer: Because blockchains are permission-less and the assets are pointed at your address from elsewhere, anybody can put anything "in" your account at any time. This leaves the door open for a great deal of harassment, fraud, and general mischief. We need to carefully consider appropriate counter measures. Where and how does a consent layer (aka requesting permission) best fit into a permission-less system?

- Multi-chain Address Space: In many instances, the same addresses can exist on multiple chains and networks. In other instances, it’s impossible for an address on one chain to exist on another. This all comes down to the compatibility of encryption methods used. When someone provides just an

Account Addresshow do you know which chain or network they are targeting? This hasn’t been a problem in single chainWallet Clients, but in a multi-chain world this problem becomes very real. There are technical standards to address this, but still not many user experience best practices. - Nascent Contract Account Support: As I already mentioned, there are a lot of benefits that Contract Accounts can bring, but they are still not widely supported for interacting with apps.

The Recovery Method & Wallet Structure

When someone asks "Can I import my wallet?" what they're really asking is "Can I use my recovery method in this wallet client to rebuild the wallet structure that contains all of my accounts?" Bit of a mouthful, I know. Let’s break it down.

Let’s start with the Recovery Methods. These do exactly what you’d expect: help to recover your accounts or set them up for the first time on a new device. There are a lot of potential ways to design recovery methods, but let’s focus on the two standards-based approaches most commonly supported by Wallet Clients today:

- Private Keys: As we saw above, every account has both a private key and a public key. If you have an account's private key, you can always use it to recover the public key and account address. It’s created from a combination of randomness and cryptographic math. Strong arguments can be made that private keys should never be user facing.

- Recovery Phrases (aka Seed Phrases/Mnemonic Phrases): These are the 12 or 24 word phrases (defined by BIP-39) that you are encouraged to back up safely & securely. Their original intention was to be a human readable way to produce the randomness required to generate a private key. They are less prone to transcription errors than a base-58 string, easier to speak aloud (see: accessibility), and possibly (though it’s a stretch for most) even memorized.

These recovery methods are incredibly powerful! They help your Wallet Client consistently derive what we’ll call the Wallet Structure: the list of all your accounts and the private keys that control them.

"Wait—what do you mean ‘derive’? Why don't you just say ‘create’?"

Because—brace yourself—every possible account in any blockchain address space already exists 🤯. Check out Dmitri Cherniak's Dead Ringers for a visually sumptuous example of this in action. So, we say derived because your Recovery Phrase is used to discover a specific public/private keypair that controls an account.

"But wait… how do you avoid two people getting access to the same account?"

Incomprehensibly large numbers of things. There are so many possible accounts that, even though we’re deriving keypairs for them randomly, the odds of generating the same one twice are infinitesimally small. You have a better chance of hitting the moon by throwing a rock. But a well designed Recovery Method lets you derive the account deterministically.

"Wait—can you clarify what you mean by ‘deterministically’? Just so I’m sure."

We say it is deterministic because the same Recovery Method will derive the same keypairs 100% of the time. Almost all Wallet Clients achieve this through the magic of Hierarchical Deterministic Wallets (HD wallet)—the most common Wallet Structure.

"OMG, yet another thing called a wallet!?" Yes.

What Is An HD Wallet?

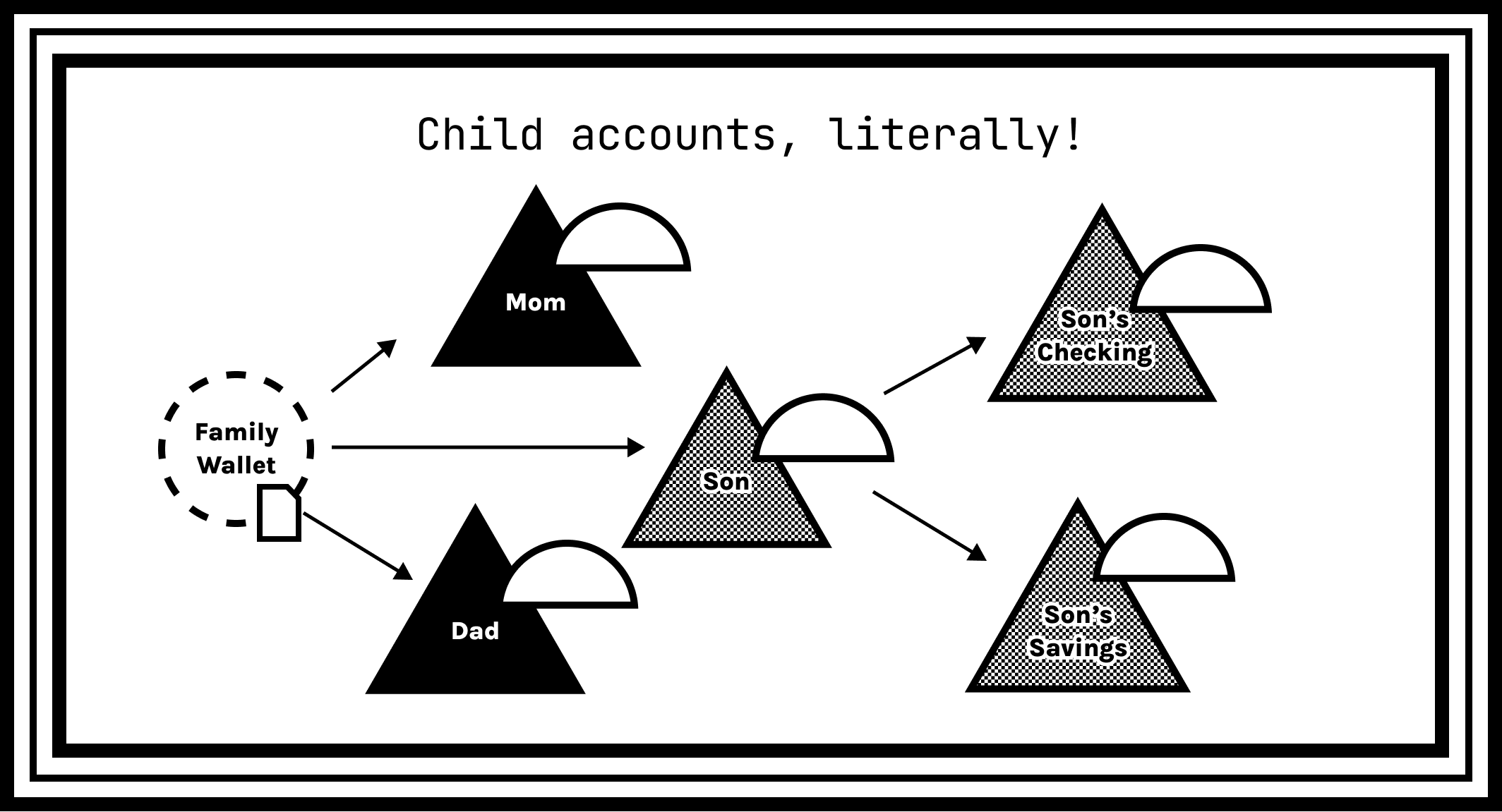

It's a tree of accounts derived from a single root keypair, and originated in the Bitcoin world as BIP-32.

An HD Wallet is a pretty interesting construct because, using BIP-44, a Wallet Client can walk what's called a derivation path and "discover" all the accounts that have associated on-chain activity—magic! This aspect of an HD wallet's tree of accounts is pretty under-explored. Most wallet clients support just a single account, or a single layer of accounts. But technically you can have children accounts, and grand children accounts, and so on. There’s no limit to the number of levels!

Now, I’m but a simple designer. There are many reasons to be cautious about how HD Wallets are used, and how many accounts and child accounts you tie to a single recovery method; as they say, don’t put all your eggs in one basket. But, it seems worth investigating them more deeply as a means of addressing at least part of the account composition problem. Not everybody has the same threat model.

Challenges That Current Recovery Methods Face

- Diverse Threat Models: Even software professionals are not security experts. It’s hard for most people to know exactly how much time and energy they should put into securing their assets—a problem that is not unique to blockchains—and what sort of practices they should routinely engage in to monitor and respond to changing circumstances. This practice is called threat modelling. There’s a lot of room for building tools and practices that help increase awareness and default people into the practices that best fit their current threat model.

- Accessibility: Though recovery phrases push accessibility forward a bit, the BIP-39 spec explicitly states "it is strongly discouraged to use non-English wordlists." The vast majority of people on Earth speak no English. So many things in this space carry with them the baggage of the programming languages that support them being English and ASCII prime.

- Fragility: You only have to make a mistake with your recovery mechanism once, and then it is compromised—or lost! You may not even realize you’ve compromised or lost your recovery method until it’s too late. It’s hard to strike the right balance between ensuring a Recovery Method is at hand when you need it, but that also secured against theft. Vitalik has written a great introduction to the importance of Social Recovery as an alternative approach moving forward.

Wallet Out

So, I hope you've got a clearer model of how the pieces of the Wallet Stack weave together. And the next 10 times you feel the world "wallet" on the tip of your tongue, I hope you momentarily pause to check that your using the most precise term you can.

I hope that, in the next Coinbase Wallet sprint, someone asks "Alex, can you fix the bug with accounts being derived non-deterministically in the wallet structure when users input their recovery method in the latest version of our wallet client?" It’ll take some practice, but over time it’ll pay dividends for us, our collaborators, and the ecosystem as a whole.

Is there any single piece of the Wallet Stack that we can simply call a "wallet", though? In Glen Weyl, Puja Ohlhaver and Vitalik Buterin’s latest white paper "Decentralized Society: Finding Web3’s Soul", they opt to use wallet as a synonym for account (emphasis mine).

We begin by explaining the primitives of DeSoc, centered around accounts (or wallets) holding non-transferable (initially public) "soulbound" tokens (SBTs) representing commitments, credentials, and affiliations. Such tokens would be like an extended resume, issued by other wallets that attest to these social relations.

I’ll save my quibbles with the word "soul" for a separate post, but as goes Vitalik’s steady thought leadership, so goes much of the community. I suspect the wallet/account terminological collapse is where we’re headed. And that is fine, as long as we aim for consistency and clarity—both in our discussions about what to build, and the UI copy our wallet clients expose.

Great challenges and opportunities lay ahead for the Wallet Stack in a multi-chain world! My only wish is that we pursue them with common terms.

Ryan Betts is Head of Design here at Fission. He's working on UX patterns for the local-first edge apps we power. This article is a summary in part of discussions and inspirations from the Web3 UX Unconference at Devconnect Amsterdam. Stay tuned as well for a proposed standard about chain-agnostic account metadata.

You can also find this post on Mirror, where you can collect an NFT of this article. Which won't actually be "in" your wallet.

Find him on Twitter and everywhere else as @depatchedmode for feedback.